The latest numbers on consumer prices are out, and they are bringing some cheer to both the economy and the stock market. The Consumer Price Index, or CPI, revealed that inflation is slowing down in December, which might influence the Federal Reserve’s decisions about interest rates in the upcoming months. Let’s dive into what this means!

What is CPI and Why Does it Matter?

The Consumer Price Index is a tool used to measure the average change over time in the prices paid by consumers for goods and services. It’s a big deal because it helps us understand whether prices are going up or down, which affects everything from the cost of groceries to how much we pay on our mortgage. When CPI rises, it usually means that inflation is increasing, which can lead the Fed to change interest rates.

Good News: CPI Growth Slowed Down

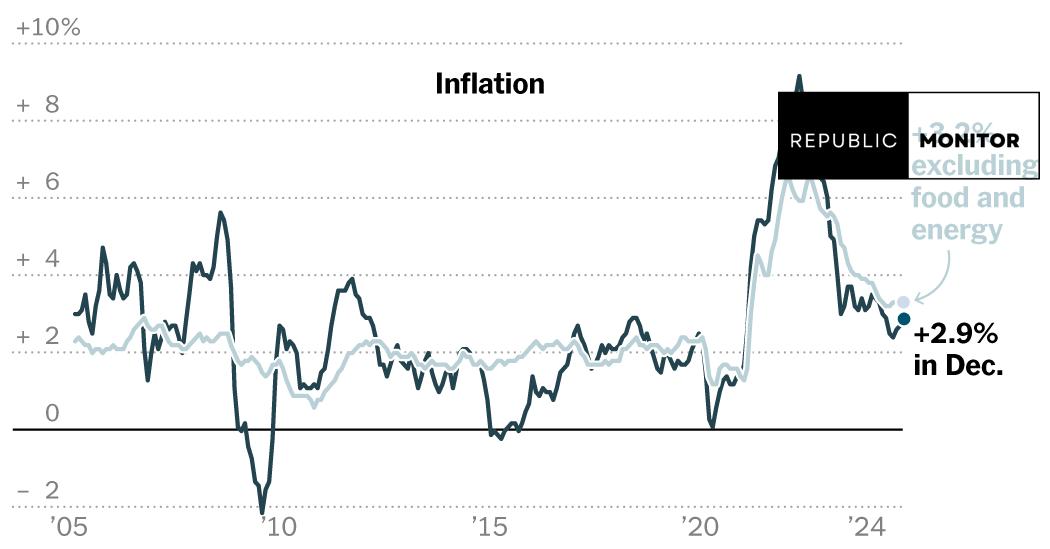

In December, the CPI rose by just 0.4% compared to the previous month and showed a year-over-year increase of 2.9%. This is good news because it’s lower than what many experts expected. Specifically, the Core CPI, which excludes volatile items like food and energy, increased by only 0.2% month-to-month and 3.2% yearly. This slow growth could mean that inflation is starting to cool off, allowing the Federal Reserve to take a breather instead of raising interest rates.

Investors React Positively

After the CPI report was released, investors seemed to breathe a sigh of relief. The U.S. stock market enjoyed a strong day, with the S&P 500 jumping over 1.8%, the Dow Jones Industrial Average rising more than 1.6%, and the Nasdaq Composite soaring by 2.5%. This uptick reflects optimism that inflation might not be as big a threat as previously thought, meaning the Fed might hold off on further rate hikes.

Federal Reserve’s Future Decisions

Experts are now debating how the Federal Reserve will respond to this data. With inflation showing signs of easing, some think the Fed might keep interest rates steady during their next meeting after cutting them three times in a row. Economists like Aditya Bhave from Bank of America suggest that the combination of a stabilizing labor market and inflation nearing the target could lead to more cautious approaches from the Fed.

Potential Challenges Ahead

However, it’s not all sunshine and rainbows. The incoming administration of President-elect Donald J. Trump could bring new economic policies that might affect prices. Some economists warn that these changes could lead to unexpected inflation, adding an element of uncertainty to future forecasts. BNP Paribas U.S. economist James Egelhof mentioned that the Fed is likely to keep a close eye on how these policies pan out before making further adjustments.

Why Does This Matter for You?

For regular folks like you and me, the CPI data is important because it directly affects our lives. Slower inflation can mean that prices for everyday items, like groceries and clothing, won’t rise as quickly, helping families manage their budgets more easily. On the flip side, increased uncertainty from new government policies can lead to fluctuations in job security and spending habits.

Table of Key CPI Data from December

| Indicator | Monthly Change | Yearly Change |

|---|---|---|

| CPI Overall | +0.4% | +2.9% |

| Core CPI | +0.2% | +3.2% |

| Shelter Prices | +4.6% | Lowest in nearly 3 years |

Looking Ahead

As we move forward, we’ll be keeping a close watch on how the Fed interprets the latest CPI figures and the potential implications for our wallets. With mixed signals in the economy, it’s crucial that both the Fed and consumers stay informed to navigate these changes effectively. Stay tuned for more updates, as we’ll be sure to share the latest news and what it means for you!