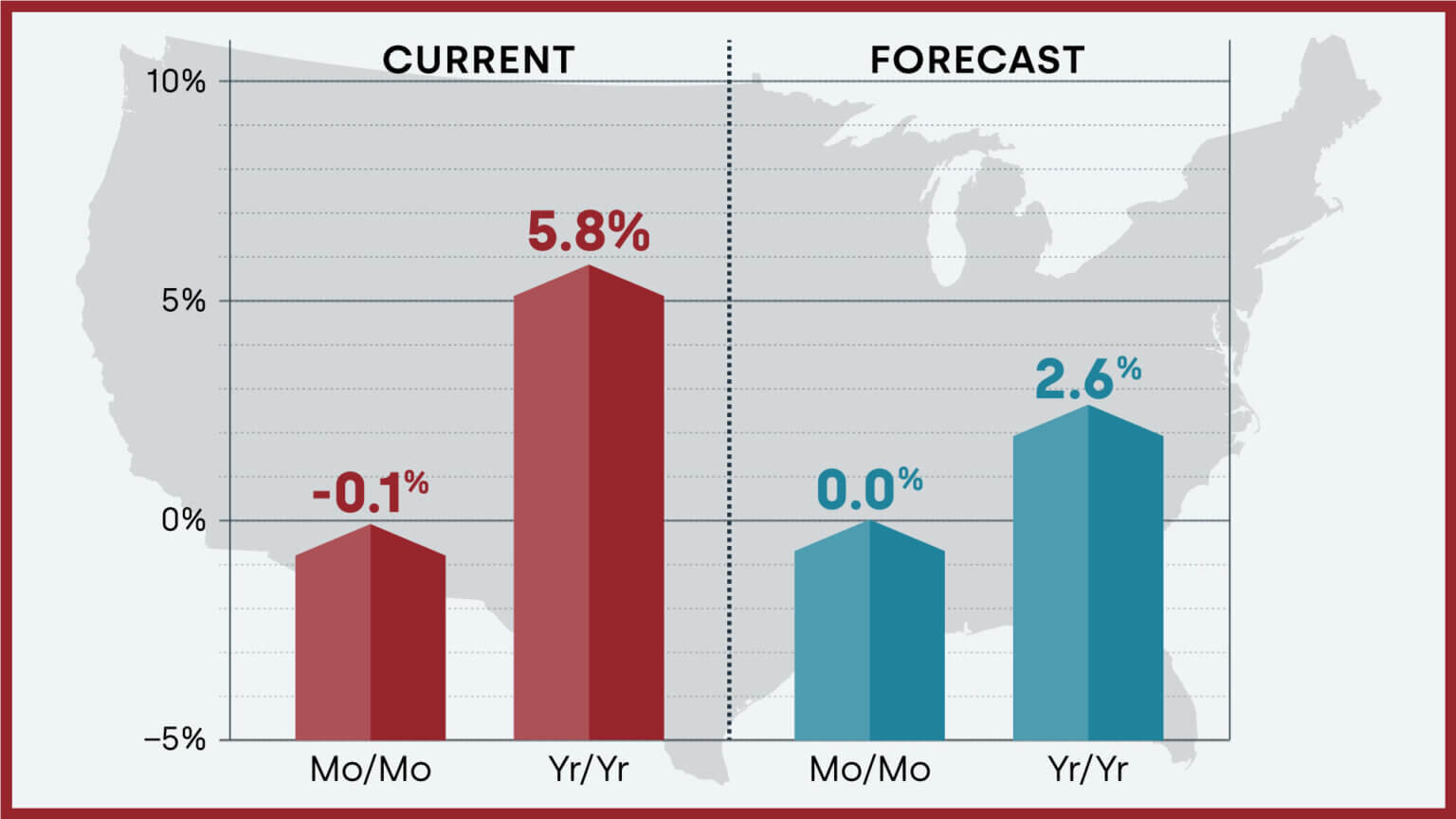

Deals of bef homes in the US fell in Spring from a one-year high, highlighting the waiting effect of high home loan rates and raised costs.

Contract closings diminished 4.3% from a month sooner to a 4.19 million annualized rate, as per Public Relationship of Real Estate information delivered Thursday. The speed was in accordance with the middle gauge of financial specialists reviewed by Bloomberg.

“However bouncing back from repetitive lows, home deals are stuck in light of the fact that loan fees have not taken any significant actions,” NAR Boss Financial specialist Lawrence Yun said in a proclamation.

Contract rates have moved back above 7%, ruining late force in the real estate market. Acquisition of new houses has likewise cooled as imminent purchasers move to the sidelines until supporting costs ease.

Other lodging information this week showed manufacturer good faith evened out off and development begins diminished. Contract rates stay over two times as high as toward the finish of 2021, and Central bank Seat Jerome Powell on Tuesday said the Federal Reserve is ready to keep rates higher for longer than recently expected to diminish expansion.

The stock of recently possessed homes available to be purchased expanded 14.4% in Spring from that very month last year to 1.11 million. While stock is still generally low, it’s been crawling up as certain mortgage holders feel they can’t postpone moving any more.

At the ongoing deals pace, selling every one of the properties available would require 3.2 months, contrasted and a 2.7-month supply in Spring of the year before. Real estate agents see anything under five months of supply as characteristic of a tight market.