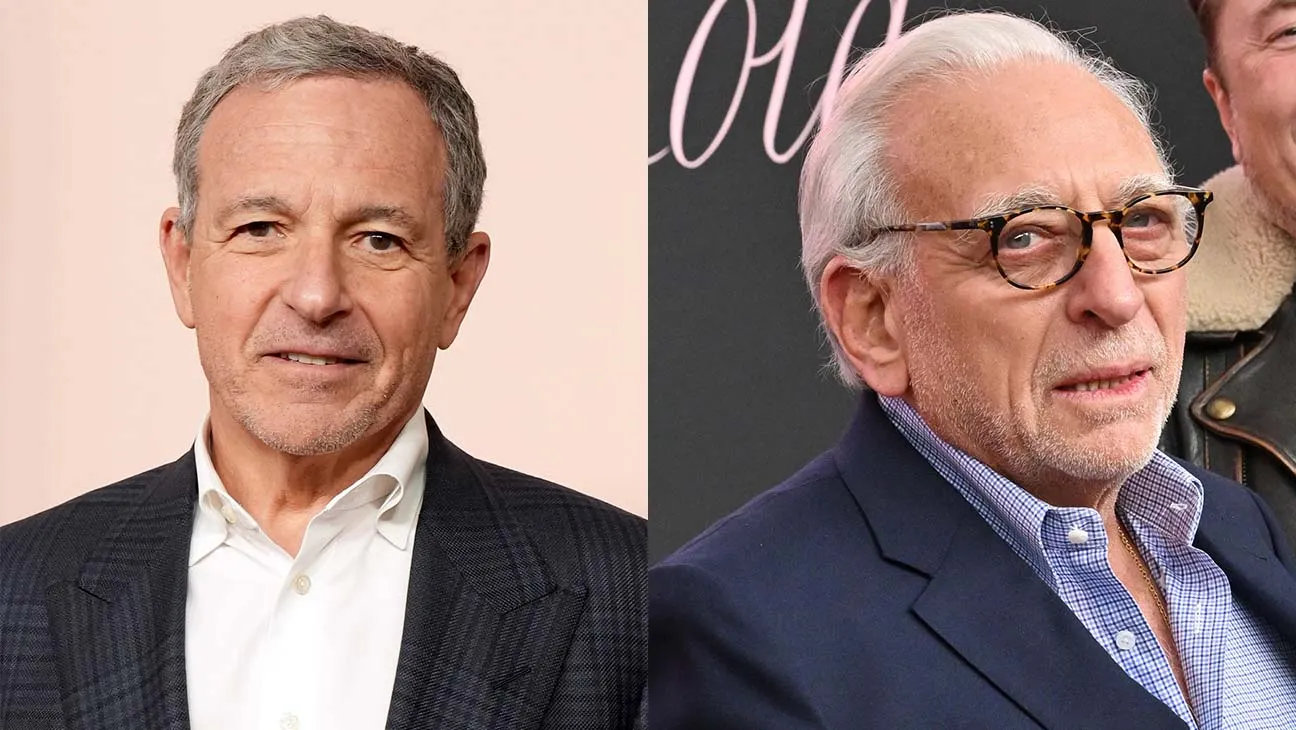

Disney has effectively fought off lobbyist financial backer Nelson Peltz in his mission to get board seats at the organization, authoritatively finishing a profoundly challenged intermediary fight that has tormented the diversion monster and its Chief Bounce Iger for a really long time.

The organization expressed Wednesday at its yearly investor meeting that the ongoing Disney board will stay in one piece following an investor vote that gave the organization’s record a success “overwhelmingly.” Around 75% of retail investors casted a ballot for Disney’s ongoing board, as per a source acquainted with the present circumstance.

The outcomes address a success for Disney in the present moment as it closes a very long time of vulnerability and interruption for Iger and the organization’s supervisory crew. Yet, it likewise implies Disney’s board will confront considerably more strain to convey results as the organization endeavors to explore shopper’s shift away from customary link bundles into for the most part unbeneficial web-based features.

Alongside its loss of Peltz, who had battled for seats for him and previous CFO Jay Rasulo, Disney likewise crushed lobbyist Blackwells Capital, which had asked investors to add its three chosen people to the flow board.

Disney’s stock exchanged lower following the outcomes, with shares shutting down over 3%.

“The strain on Sway Iger will remain truly right,” Needham expert Laura Martin told Yippee Money Live following Wednesday’s outcomes.

Disney had gotten help from high-profile intermediary firm Glass Lewis, notwithstanding the support of prominent names like JP Morgan President movie producer and “Star Wars” maker George Lucas; the grandkids of Walt Disney and his sibling Roy; and Laurene Powell Occupations the widow of previous Macintosh Chief Steve Occupations and a long-term financial backer in the organization.

Preceding the vote, Peltz got the sponsorship of compelling intermediary warning firm Institutional Investor Administrations alongside outstanding investors like the California Public Representatives’ Retirement Framework (CalPERS), the country’s biggest public benefits store; Neuberger Berman, a worldwide resource director; and individual extremist Ancora.