In a bid to enhance taxpayer confidence, IRS Commissioner Daniel Werfel assures the public that security flaws leading to data theft have been successfully addressed. The focus now shifts to providing taxpayers with a smoother and safer filing experience this year.

IRS Responds to Data Security Issues and Offers a Better Tax Filing Experience

Security Concerns Addressed

The Internal Revenue Service (IRS) has taken swift action to rectify vulnerabilities in its systems that previously allowed unauthorized access to taxpayers’ sensitive data. Commissioner Daniel Werfel is determined to rebuild trust by assuring the public that significant strides have been made to fortify the agency’s cybersecurity defenses.

A Pledge to Congress

In a recent appearance before Congress, Commissioner Werfel not only acknowledged past shortcomings but also affirmed that the IRS has implemented robust security fixes. The Commissioner’s testimony aimed to reassure lawmakers and taxpayers alike that lessons have been learned, and the agency is committed to safeguarding sensitive information.

A Promise for a Smoother Experience

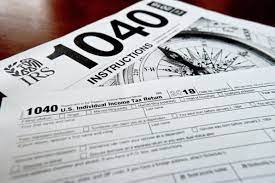

Werfel’s commitment extends beyond just addressing security concerns. He promises taxpayers a much smoother and hassle-free filing experience this year. The focus on user experience becomes paramount as the IRS aims to mitigate the stress often associated with tax season.

Learning from the Past

Acknowledging past challenges, Commissioner Werfel asserts that the IRS has undergone a transformative process. The lessons learned from previous security lapses have become the catalyst for comprehensive improvements, ensuring that taxpayer data remains shielded from malicious actors.

Fortifying Cybersecurity Measures

The IRS has actively worked on fortifying its cybersecurity measures to withstand evolving threats. The emphasis is on proactive measures, ensuring that potential vulnerabilities are identified and addressed before they can be exploited. The goal is not only to meet current security standards but to exceed them, creating a robust defense against data breaches.

Public Confidence Restoration

The assurance from Commissioner Werfel is pivotal in restoring public confidence in the IRS. Taxpayers, who entrust the agency with their sensitive information, can now expect a higher level of security and professionalism. The proactive stance taken by the IRS reflects a commitment to evolving with the technological landscape to better protect taxpayer data.

Conclusion

As tax season unfolds, the IRS is on a mission to redefine its image. Commissioner Daniel Werfel’s pledge to Congress and the public signifies a dedication to rectifying past mistakes and creating a more secure and user-friendly tax-filing environment. With the promise of improved cybersecurity measures, taxpayers can approach this year’s filing with a newfound sense of assurance and trust in the IRS’s commitment to safeguarding their sensitive information.