If the state Legislature approves a recently proposed plan, Michigan may pay inflation relief cheques to all tax filers. Michigan taxpayers might receive $180 from the state this year under the proposed Lowering MI Costs proposal. Though the sum may not appear significant, authorities said Monday that for individuals working full-time and still struggling, the checks would work in tandem with enhanced tax credits to provide more meaningful relief. Here’s what we know so far.

Who would be the lucky recipient of a $180 check?

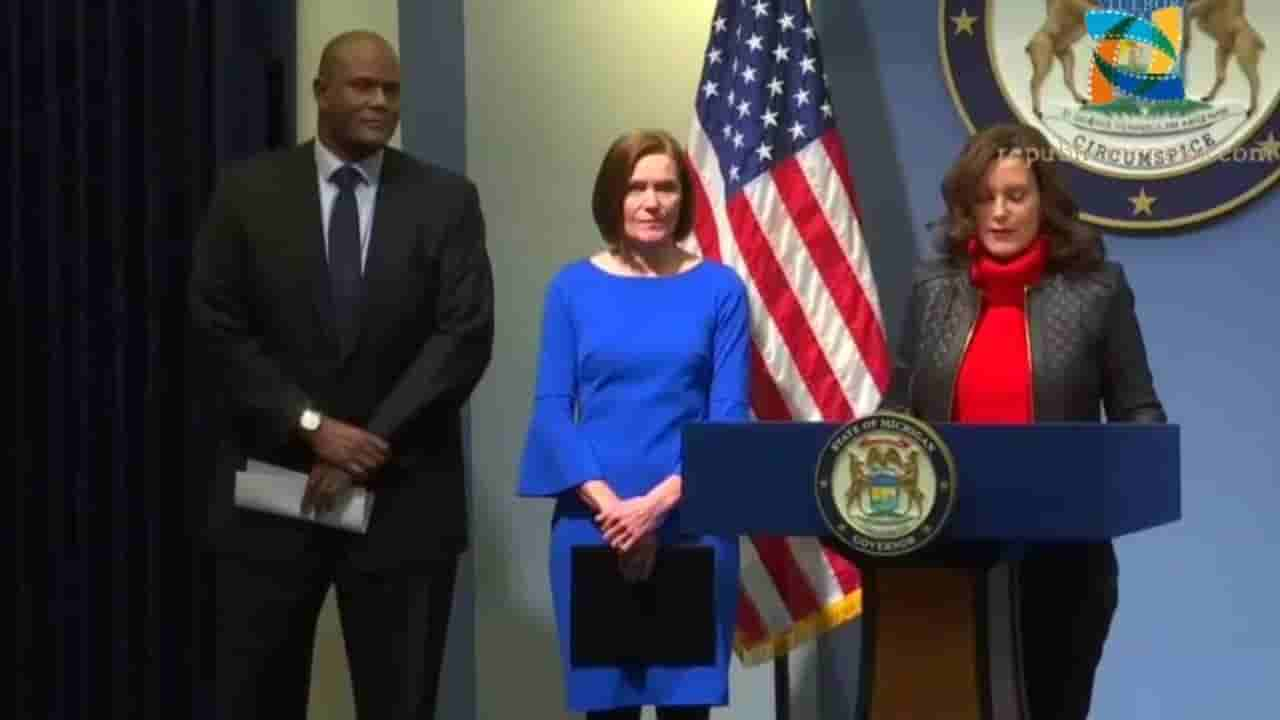

Michigan Gov. Gretchen Whitmer announced on Monday, Feb. 6, that under the Lowering MI Costs plan, all taxpayers would get a $180 inflation relief check.

It is assumed that married couples who file their taxes jointly will only receive one check rather than two. It is also unknown whether dependents will play a role in the amount of money delivered to a tax filer, but this appears to be different. A date for when checks might be mailed has yet to be made public. Lowering Michigan Costs must yet be approved by the state House and Senate and signed into law by Governor Whitmer. If that occurs, Whitmer stated that the checks will be distributed “as soon as feasible.”

What is the plan for lowering MI costs?

Democrats Michigan Gov. Gretchen Whitmer, Senate Majority Leader Winnie Brinks, and House Speaker Joe Tate revealed the plan on Friday, Feb. 3. Officials say it’s an attempt to bring immediate financial comfort to people of Michigan who are dealing with high inflation. The $180 inflation relief cheques are merely one part of that strategy. Legislators want to eliminate the state’s retirement tax and raise tax credits for employees and their families. According to Gov. Whitmer’s office, the plan will phase out the state’s retirement tax over four years and “ultimately puts an average of $1,000 back in the pockets of 500,000 people.” Officials stated that the exception would be applied equally to public and private pensions.

Will the plan be implemented?

Because Democrats suggested the plan, it is likely to be approved because Democrats control the state legislature and the executive branch. On the other hand, Whitmer, Brinks, and Tate stated on Monday that they expect bipartisan support for this approach. It is still being determined how long the Legislature will take to vote on the proposed plan. On Tuesday, lawmakers will reconvene in the Legislature. The Michigan Working Families Tax Credit counterpart of the federal Earned Income Tax Credit would be increased from 6% to 30% under the plan.

Read Also – Stimulus Check-In January 2023: Find Out More Updates