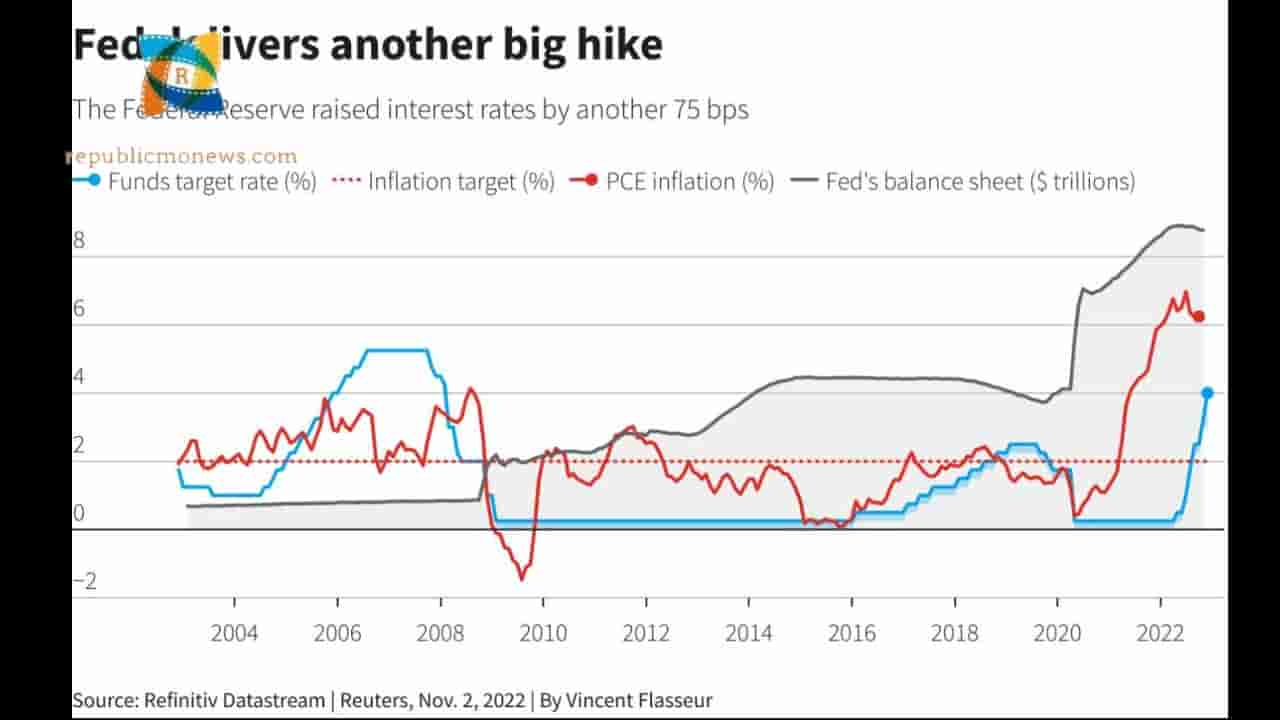

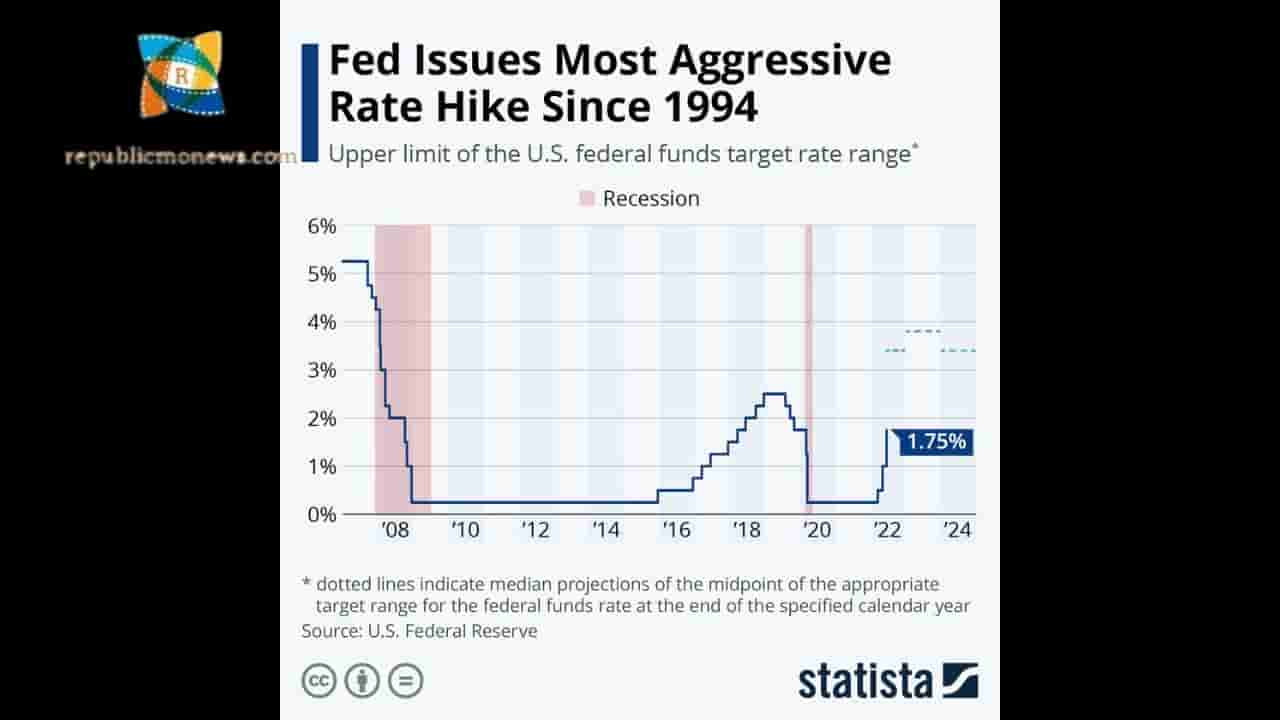

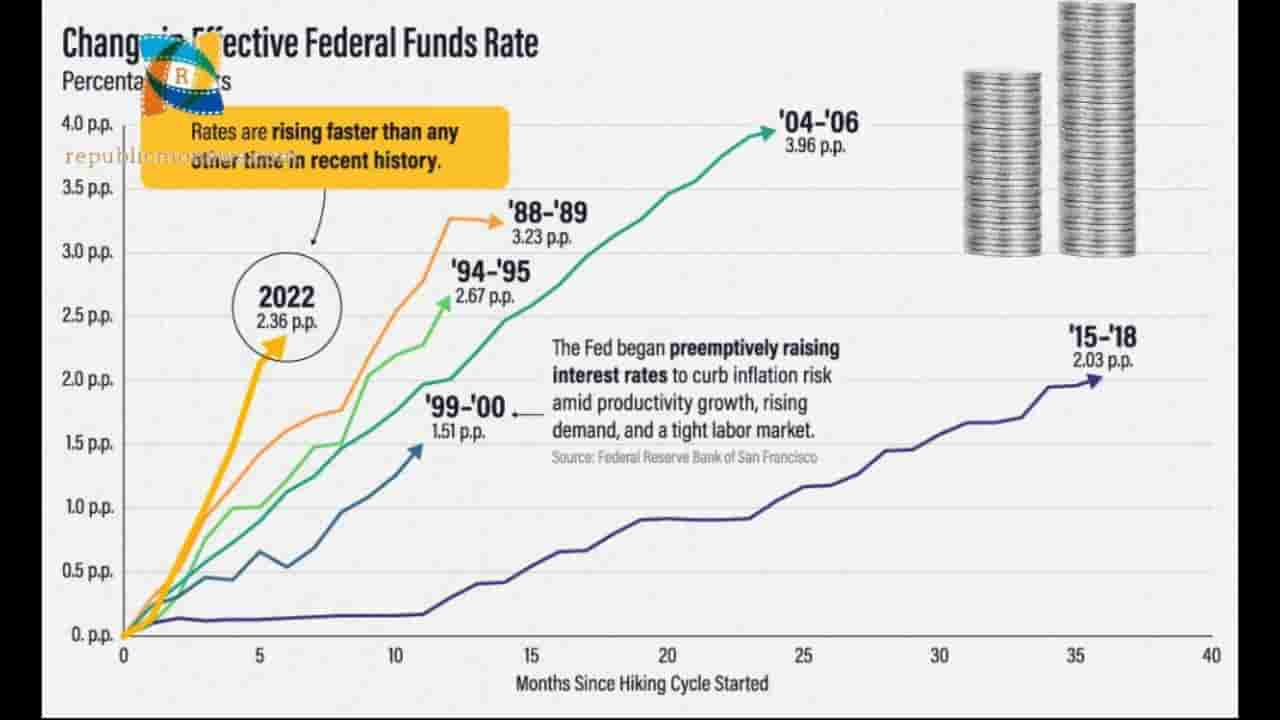

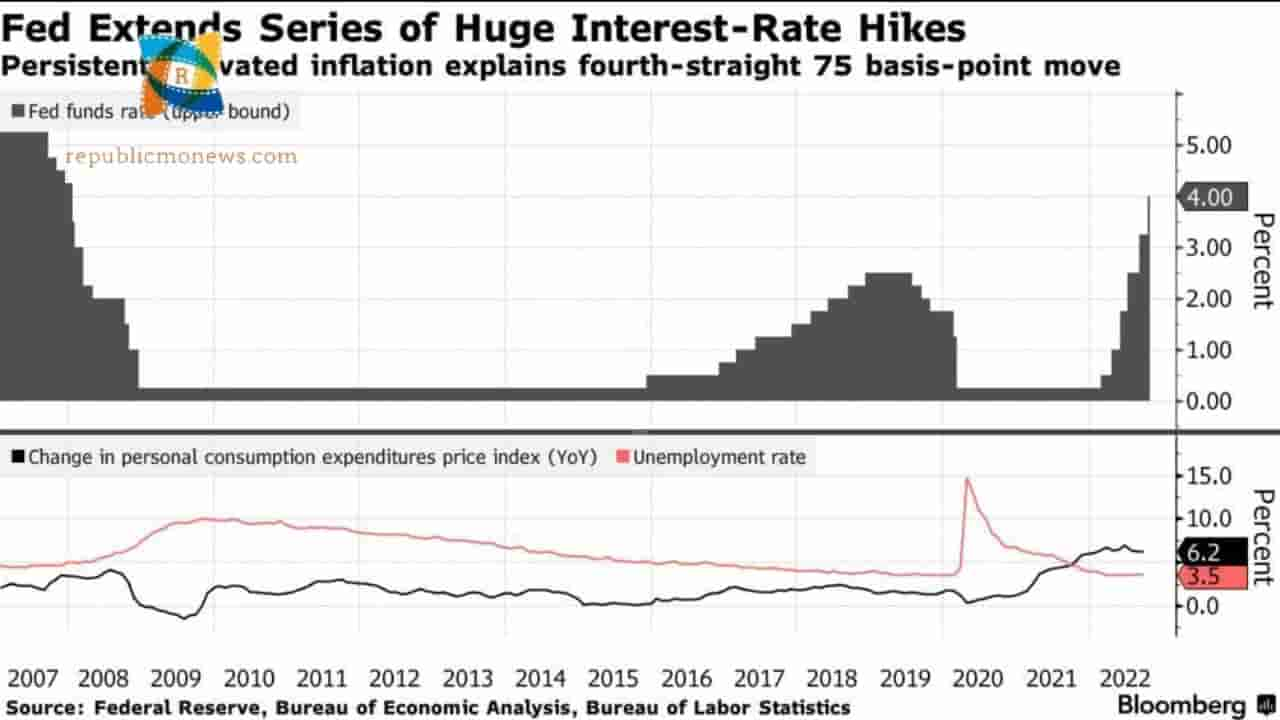

Fed Rate has suddenly raised dates inches rates in the third quarter of the year as there has been a 0.75% increase in the overall intestine rate of this particular rate system and the increase was decided suddenly on the second of November 2022 as the borrowing cost has increased in a further manner It is seen that the inflexion point has also tightened up. The monetary policy is changed over the last 40 years. The central bank of the USA has reached its rates in the further edition of the financial year as it has been the third quarter of the Year. There are certain important details about the increase in the percentage while the country’s inflation rate started affecting the economy.

Current Hike in the Fed Rate

Fed Rate has been the general borrowing rate of the overall Central Bank of the USA, and suddenly this rate increased on the second of November 2022 with an increase of nearly 0.75% as a whole. All the members of the central government and the governing bodies of the USA have jointly decided that there should be an 0.75% increase in the overall rate of the central bank borrowing process as the inflation rates in the country have started affecting the economy of the country, so the individuals were borrowing money in and from the country should pay a 0.75% more interest to the country to maintain the economy rates of the country.

Previous Hike in the Fed Rate

In the past few monetary years and the previous policies of the Central Bank of India have recently not seen any increase in the overall credit system’s inches rates. In recent times, there has been a similar credit System provided by the central bank of the USA for the person who is taking money from the country. Recently there has been and high increase in the inflation rates of the country, which has created a very fall impact on the overall country and has also led to an increase in the inflation and a decrease in the overall economy of the country. The government said together and decided that the only way to maintain the economy with a low inflation rate would be making the interest rates a bit high.

No Particular Decision Taken

Various investors and individuals mention that the blistering decision taken by the central bank of the USA is not final, and this can be a decision taken for a monetary transaction policy of this particular year. It is expected that within marks 2023, the country’s economy will be stable. There will be no return points for the country, which will create a proper economy for the USA and after the economy of the country is stable, it will create a proper impact on the banks. They will reduce the interest rates of borrowing back to normal. It is still not confirmed whether the decision taken by the central bank is permanent or not.

Improvement of Fed Rate in Future

The increase in the interest rates in 2022, which has been 0.75%, is still not confirmed, and the rates will be similar in 2023. An increase in the 0.75% interest rate in the country is very beneficial for a country like the United States of America. Still, it is very difficult for the country to maintain this particular rate in the present scenario, so it is very well expected that the rates revised by the central bank of the USA will be changed within 2023. The United States America government will directly decide after an overall meeting. Still, the country needs to stable the economy and reduce the inflation rates for which the interest rates had to be increased.

Read Also – How To Obtain Your November Payment Under The Inflation Relief Checks?