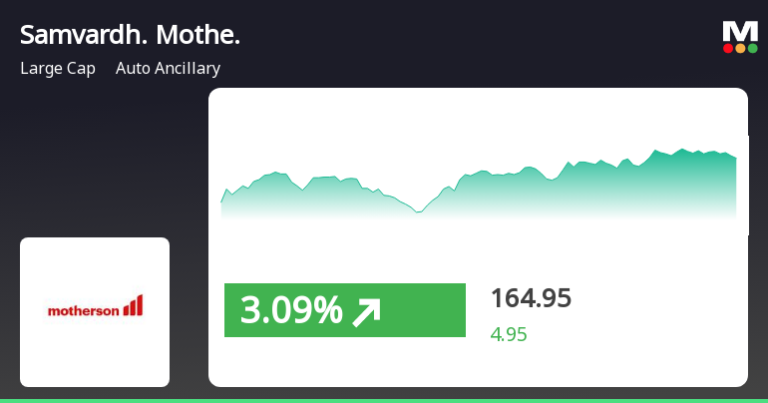

Samvardhana Motherson Stock Gains Momentum Before Dividend Declaration

Ahead of its upcoming board meeting to consider and approve a proposal for an interim dividend for the financial year 2024-25 (FY25), shares of Samvardhana Motherson opened on a positive note in today’s trading session. The stock began the day at ₹129.99 per share on the National Stock Exchange (NSE) and quickly gained momentum, reaching…